Category: Uncategorized

Life as an entrepreneur in a ‘woke’ world

From a young age we realise that not everything is within our control and not everything goes to plan. A lesson that many of us struggle to accept – either because we secretly like to be in control and/or because society tells us that we must always carry on with something, despite anyone or anything trying to get in the way.

Fast forward to when a prospective entrepreneur decides to set up a business and there are many considerations and factors that may attempt to or will indeed ‘get in the way’. When a business then decides to embark on a growth trajectory and employ people along the way, the idea of total control or everything going to plan, starts to look even more shaky. More needs to meet, more opinions to listen to and consider, and the fact that somebody’s perception is always subjective, are just some of the things to navigate. What many entrepreneurs fail to anticipate however, is the level of seeming control that the general public has over their business – even if their output isn’t a brand or product that is for public purchase or consumption. Put simply, we live in a world where any business is everyone’s business.

Society has changed considerably over the last twenty years and even more so over the last two years to one where people are much more aware of and indeed vocal about their view on societal, cultural, and political topics. Areas that our parents and grandparents wouldn’t have voiced a concern about or even had an opinion on, as it risked being ostracized by others within their local community. Today, the practice of voicing an opinion is somewhat essential to cement one’s position in the community – even at the risk of local or worst still, public backlash. Never has standing up for one’s rights or views been so important. This is, to a large extent, a good thing that has somewhat been long overdue – especially when it comes to people in society who wouldn’t have had the same rights as, for instance, heterosexual white men and white women to a lesser extent. The term ‘woke’ has been coined to describe what feels to be this distinct societal change. The definition of ‘woke’ is as follows:

aware of and actively attentive to important facts and issues (especially issues of racial and social justice)

Source: Merriam Webster

Whilst the term has, at times, been misused in the media and cast upon people who arguably have a valid point in what they are saying but have gone about making this point in a less than palatable way (think of Greta Thunberg or Extinction Rebellion in the UK), the purpose behind this wokeness should not be ignored by entrepreneurs. However, there is the possibility that certain entrepreneurs will overthink things or become fearful of fully running with their vision for their business for fear of upsetting someone and the business being attacked, without the ability to ‘fight back’ so to speak. On the other hand, there are certain entrepreneurs who don’t care about what others think, which in one respect is needed in order to succeed, but in another, there does need to be some awareness and mindfulness – especially if said entrepreneur wants to take their business public one day. The public and social media in particular has the power to quite literally sway share prices overnight if there is a big enough issue or backlash. So the big question is what exactly do entrepreneurs need to be mindful of in this woke world, whilst continuing on their path in a determined and mindful way?

In a recent podcast interview with our CEO Daniel Hanson, we spoke about his views on the issues that entrepreneurs need to be mindful of when it comes to the woke world that we live in. To listen to this episode please click here. For ease, below are the key points that were raised during this interview, which covered a multitude of areas including the opportunities that the woke world presents for creative entrepreneurs; whether the renewable energy agenda is full of political hot air; and how to tune into the right type of news for you.

- The overall pace is a lot faster in today’s market and patience is much reduced. So in order to grow a business you need to be more concrete in your decisions and at a faster pace. You also need to be able to adapt a lot more quickly but figure out your strategy upfront and try to anticipate the woke topics that may present themselves in the short term.

- Trying to do the right thing when it comes to being mindful and sensitive to societal and cultural issues is a good thing but remember that you cannot please everyone.

- At certain points in time the market will like you, but other times it may not. Brands can also be made or broken a lot quicker but can also rebound a lot quicker. You cannot create a super pure/good business and be commercially optimum. There will always be a way of operating, as a business, that isn’t being as green, mindful, or pure as everyone would like you to be.

- Take it for granted that nothing is confidential anymore and everything is up for grabs.

- Most of the great businesses around us today were built in a downturn and when a lot of people needed help. You then get paid to essentially help those people with a service or a solution.

- There is an overflow of liquidity in the market right now. Prices are better if you want to acquire a business. And if you want to expand, competitors may not be wanting to, so it could be a good opportunity to do so if things stack up. There is also an overflow of SPACs looking for targets right now.

- The market for green energy is better than ever. Technologies that have been in existence and ignored for 20 years are now getting noticed, so entrepreneurs who have devised them or can repurpose them to accelerate the deployment of stable, independent, and local energy will in a very good position. Entrepreneurs in this space should look to secure help and funding and accelerate 5x faster if they can. The political landscape has talked a lot about green energy but done very little for decades and action is now needed if they want to make a difference.

- The green ‘message’ and telling people the world is going to end if we don’t take action asap isn’t working. The world won’t end, but we do need a greater focus on solutions.

- Some ignorance is bliss in the current woke world, as everything is overly dramatized. Journalists are the authors of news stories and they put their spin things which can be lesser or more negative than needed, so pick your news sources wisely. It is easy to get sucked into a rabbit hole and this will lead to negative energy in your life. Compare two different new stories about the same event and you will realise how much of the news is skewed by the journalists themselves.

- And finally, good ideas and good intentions always win in life.

Don’t forget to listen to the full episode and subscribe via iTunes or Spotify to be alerted to future episodes as part of OMNIA Global’s Dot Connector series.

The mental health of entrepreneurs

An entrepreneur’s mental health is typically looked at more closely once the individual’s journey has reached a place where they deem themselves and/or their business a success. Perhaps they are asked about the lessons they have learnt or how they would’ve done things differently. Perhaps the reflection takes place at a stage where other areas of their life, such as their romantic relationships, have irretrievably broken down, and the entrepreneur wishes he or she had given more time to their personal life and less to the now successful business. This is not always the case, but life is about balance after all, and building a successful double-digit business can be likened to raising a small child with little time to do much else in the early stages.

So, why are entrepreneurs not being prepared for the impact that building a business can have on their mental health? Because it is somewhat expected that an entrepreneur’s mental health will be impacted during the build phase of their business, and that it is simply par for the course. To some extent this is true, but we believe – from observational and personal experience, that entrepreneurs can prepare themselves for what is likely to impact them emotionally, and share this with their family, so they too are aware of the possible impact on them if their partner is to embark on the journey of building a business.

The bigger picture

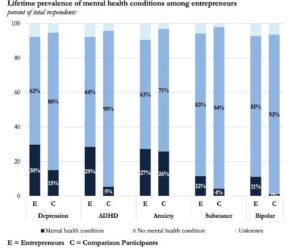

In a 2020 study conducted by the National Institute of Mental Health, the following graph was produced, which illustrated the fact that entrepreneurs outweigh comparison participants in every mental health condition category. Considering this study was undertaken in 2020, which was at the start of the Covid pandemic, the results of such a study if undertaken again today, would no doubt present even more concerning reading. However, given the world is still edging at a slow pace towards mental health openness and acceptance, it is unlikely that an entrepreneur who is focused on the imminent business journey ahead of him or her would want to get a formal diagnosis for a mental health condition – even if they know deep down there is something that needs addressing. However, what we feel that entrepreneurs can look to do, as part of the preparation phase, is to start accepting who they are and the way they do things – even if it is different to lots of other people or different to how the media suggests things should be done when scaling a business.

Source: Forbes article Oct 4, 2020: ‘Why entrepreneurs need to talk about their mental health’

In fact, in a separate study conducted by Michael A. Freeman of the University of California, he says: “People who are on the energetic, motivated, and creative side are both more likely to be entrepreneurial and more likely to have strong emotional states.” So, there is clearly a tendency for entrepreneurs to experience stronger emotional states such as feeling low, high or even manic, or struggling with attention span. One could even argue that such emotional states – once the person emerges and feels a little more like their usual self, can give way to great ideas, epiphany moments, quicker decision making and so on. Mental health struggles can also be so profound, that significant levels of resilience are built – a key ingredient needed for an entrepreneur’s journey, and risk-taking in business feels easier because the individual has been in worse places and has learnt that life goes on and humans can and will bounce back from struggles.

Forewarned is forearmed

At OMNIA Global, we feel that self-awareness, self-acceptance and mentally preparing yourself and those close to you, are key ingredients prior to navigating the world of growing a business and weathering the potential mental health storm. In a recent podcast episode with our CEO, Daniel Hansen, he outlined several things that entrepreneurs can consider, plan for and/or share with their immediate family before embarking on their business journey.

Whilst not all of the points below are directly about our mental health, they are pinch points that may well impact an entrepreneur’s mental health or way of thinking, and we hope the framing of each one sets a more realistic and reassuring bar.

- Sleep – if you are supposed to have all the answers as the founder of the business, you can’t if you are tired, so make sure you get the right amount of sleep for you personally. Your body will guide you.

- Tell yourself the journey ahead will take 10 years and not the aspirational 2-3-year time period. Why? If you know it could be a 10-year journey, your way of operating and working will be a lot more sustainable. And many people easily reach 2 years in their business journey, but then continue for 10 years anyway, so it really is a long-haul process.

- Be realistic – nobody can work 100 hours per week for 10 years.

- Work out what success looks like to you and keep it to yourself. Shut out the toxicity that exists on social media, which suggests that you need to work excess hours to make something a success. This is nonsense.

- Focus on what capital you are able to raise and your profitability.

- Look at how you can improve your performance without your performance being a high priority. Quick wins when it comes to time and communication are often the things that aid personal performance.

- Doubt is normal. Many entrepreneurs think their business journey is taking too long, but often this is because society is creating artificial barriers and measures of success. Feel the doubt but move forward.

- Think you need to be under 35 to be a successful entrepreneur? Many successful entrepreneurs are in their 40s and held a corporate role before attempting to launch and scale their own business. It is never too late and life experience is a good thing to take into the development of a business.

- Romantic partners, when consulted by their partner who announces they are going to scale their business, often want some sort of timeline. This is dangerous territory and creates the ticking clock effect, which is not beneficial for the entrepreneur or the partner.

- Review who is calling you each day and taking up your time. Do you bounce off them or do they sap your energy and move you away from the ambitious person you once started out as?

- Life coaches: If you are willing to spend money on marketing and with no real sense of whether it will achieve the results you want because your business is new, then you can afford a life coach. An essential part of your journey and ideally, somebody who has been in your position, so they can act as a lifeline during the good and not so good times.

- Preparation is key – have conversations about your mental health before you embark on your entrepreneurial journey. If you know you can have high highs or low lows, then the likely stress you will encounter when growing your business will only exacerbate this. Work out what your pinch points are early on and work on them with the life coach or a therapist.

Please click here to listen to the episode with Daniel Hansen in full.

SPACs and the power of the story

The much-debated question in the market at present is whether SPACs are being misused and overly inflating the potential value of companies that are not ready or even organised to realise such growth? And is this because they have failed to assemble an execution-minded management team and/or because they have not mapped out a robust and creative strategy that builds credibility and trust in the company?

A little more about SPACS

With a SPAC transaction, a private company becomes publicly traded by merging with a listed shell company; the SPAC. SPACs are an alternative to the traditional IPO route and push the business into the public listing space at a faster pace. As a listing route, it is also more cost effective.

Why has the popularity of SPACs increased in recent times? Because you negotiate the pricing with the SPAC before the transaction closes, as opposed to your IPO price depending on market conditions at the time of listing. If the market is volatile, a SPAC provides a lot more certainty surrounding price.

However, as mentioned above, in recent times SPACs have hit the press in a less than desirable way. This is due to investors ‘cashing in’ before a number of public listings, subpar management teams and SPAC founders or sponsors, who are typically given a 20% ‘promote’ of the shell’s company more or less for free – which is for their efforts in finding a target company, not being particularly motivated to find a company because they received the shares for free and will cash in regardless. On a more positive note however, there appears to be a new generation of SPAC vehicles emerging, that each are backed by a more accomplished group of sponsors who are better able to find attractive merger targets.

The positive outcomes

Listings using SPACs have led to many companies realising their growth ambitions and financially being deemed successful over the years. One example is sports betting site DraftKings, which originally merged with a SPAC called Diamond Eagle. Diamond Eagle had already raised USD 400m in its share sale, and then at the same time as announcing the merger with DraftKings, it announced that Fidelity Investments would lead a group of funds buying another USD 380m of new stock. After the merger, and despite spending USD 200m in cash to buy another company, it still had more than USD 500m on its balance sheet and a resulting value of USD 2.7bn.

The not so positive outcome

Media company Buzzfeed went public not so long ago by merging with a SPAC. Its share price immediately spiked by 35% but then closed down 11%. Buzzfeed expected to raise just USD 16 million from its offering, because days before, 94% of the USD 287.5 million raised by the SPAC was pulled by investors. This was reportedly due to investor distrust in the company’s plans.

Enhancing the investor reaction to a public listing before it happens

Should the process of going public using a SPAC, which has been likened to writing a blank cheque, be bolstered – pre-listing – with a strategy that builds credibility and trust in the company, as opposed to it simply being a numbers game? One tactic that SPACs could look to adopt is to develop a brand strategy, which will explore and decide on the brand story, its messaging, the company vision and go-to-market strategy from day 1 through to day 365. A brand strategy also has the ability to bind together the management team, who is then organised to go in one clear direction; the investors, who can buy into the vision, but also understand how it will be executed in the short- and long-term; and the general public, who has the power to make or indeed break a business that is about to be listed or newly listed with speculation on social media, and who is often forgotten during the listing process.

Some may wonder why you would opt to spend precious budget on a brand resource prior to a listing, but the difference it can make is nothing short of transformational. Imagine if someone paints you, as an investor, a vision that addresses societal or environmental issues, or taps into much needed diversity in a saturated market, or simply tells you a story with robust evidence to back it up and in a creative way that appeals to your senses. Then, you will engage much quicker and on a deeper level if you resonated with their story, than if you were given a standard investor deck presentation, and on the front, it featured the words ‘Invest in a company that will sell innovative HealthTech products and disrupt the technology sector around the world’, to give one example.

Not forgetting the hero and the villain; social media

Whilst we are on the topic of branding and all things marketing, it is worth considering the role that social media plays during the SPAC process leading up to a public listing. Social media has the power to not only build a brand and accelerate its growth, but also to hinder the growth of a business through social media speculation. If a message appears in clusters, investors are understandably inclined to start digging for the truth. Even if they cannot find what they need to confirm or disprove the message, it will plant a seed that will impact the share price through investor behaviour.

“Given the speed at which a bad rumour spreads on social media and the still evident bad press surrounding SPACs, any company looking to go public via a SPAC should be willing to ‘join the conversation’ on social media to clarify any concerns about the company and quash the fast-spreading nature of speculation leading up to the listing date.”

Lauren Marks, Brand Strategist, OMNIA Global

To conclude, the takeaway message for us as a business and the one that we want others to be mindful of is that companies going public using a SPAC need to inject strategic creativity to not only help elevate the entire process, but also help bind the management team, the investors and the general public. With a robust brand strategy as described above, there may actually be a reduced risk of social media speculation and people ‘filling the gaps’, but the management team should still be willing to communicate beyond their target investors and to think more long-term, when it comes to communicating the brand to the wider world.

Want to hear more? Please take a moment to listen to our CEO, Daniel Hansen, impart his view on SPACS as part of a succinct round-up of topical issues that entrepreneurs have to be mindful of when growing their businesses and ultimately taking them public. Click here to listen.

Time to be honest about the transition to green energy

Even before the election, Germany had taken huge steps towards the green transition; the so-called “Energiewende” in Germany had started. In 2011, former German Chancellor, Angela Merkel (CDU), announced a phasing out of Germany’s nuclear power plants. And Germany does not lack ambitions; by the end of 2022, the last three of Germany’s nuclear power plants will be shut down, the Germans will reduce their CO2 emissions by 60% before 2030, and they have decided to shut down the last coal-fired power plant by 2038 at the latest. Finally, the new government wants to have 80% renewable electricity by 2030 compared to the target of 65% from the previous government.

Driving through Germany on the Autobahn, one can easily see what is likely to replace nuclear power: wind turbines. As far as the eyes can see across the German landscape, they see wind turbine after wind turbine of a significant size.

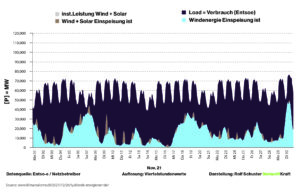

But in a country with a population of 80 million, can wind turbines realistically replace the power from coal and nuclear power plants? Even if we add solar panels to the equation, the data says no. The graph below shows the amount of energy produced by wind turbines and solar panels (blue and brown) in Germany in November 2021, together with the amount of energy consumption (purple). From this example, it is obvious that Germany is far from being able to cover their current energy consumption with wind turbines and solar panels.

How will they keep the lights on in Germany?

Providing the Germans with enough power from wind and solar sources to cover their current energy consumption would require at least a tripling of the current capacity from wind and solar. That might sound like a straightforward solution, but the main issue with wind and solar energy will always be the intermittency of these energy sources, as there will never be a guarantee of the amount of sun and wind that we receive each day. We simply need to be able to generate power from different sources of energy to cover our consumption every minute and to avoid an electricity gap.

And then, we have not even talked about “NIMBY” (Not In My Back Yard) yet. We want to be oh so green as long as it is not interfering with our daily lives – or the view from our backyards. In Germany, a greener government has been elected, but at the same time, the protests against the gigantic wind turbines that keep popping up around the German landscape just get louder and louder. This is due to the noise levels from turbines that disturb people’s sleep and the wings that disturb the views from people’s houses. Many Germans are simply against the Energiewende taking place in their backyards.

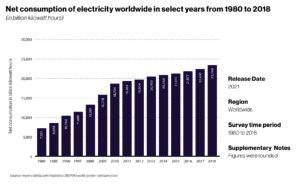

Also, let’s not forget that despite the constant focus on going greener, our net consumption of energy has continuously increased:

Wind turbines are part of the solution, but just as we need to solve the need for multiple sources of energy, including nuclear power, we also need to consider how and where wind turbines are manufactured, decommissioned and ultimately disposed of. Wind turbines are made, in part, from oil, and solar panels are made using coal. At present, China manufactures a large amount of the world’s supply of solar panels and wind turbines, but in real terms, this means that we have exported our CO2 emissions to a country with cheaper production. When the life of a wind turbine comes to an end, they are buried at so-called ‘wind turbine graveyards’, with no solution on how to get rid of them for good. In particular, the wings, which consist of fibreglass that does not burn, and so are difficult to dispose of.

So, are wind turbines providing a truly a green-to-green solution? No. One possible solution is to focus on reinvigorating and extending the life of existing wind turbines, rather than building them from scratch. This means less, if any, opposition from locals who are accustomed to the view and noise, zero carbon being expended because they are already in place, and additional time to invest in research that solves how to decommission the turbines in the greenest possible way.

Has the pandemic disrupted our working life?

The concept “remote work”, which we have all become so familiar with, is not new – the demand for flexibility in where and how people work has been building for decades. Before the crisis, surveys showed that 80% of employees wanted to work remotely at least some of the time. Over a third would take a pay cut in exchange for the option.

During the pandemic, we all got a taste of what life could be like with a more flexible job that includes days working remotely – and it seems safe to say that the pandemic has accelerated a trend, which much likely would have peeked way later than it will now. According to McKinsey’s report “The future of work after COVID-19” from February 2021, remote work and the use of virtual meetings are likely to increase – although not as intensely as during the pandemic as many people are forced to go back to the office.

“At OMNIA, we have a fully remote workforce – which we have had since we started in 2009. For us it was business as usual when the lockdowns hit. It just made everything easier for us, when everyone else were doing the same – virtual meetings became the norm. It was like an epiphany for people in 2020!”

Daniel Hansen, OMNIA Global Founder & CEO

Global Workplace Analytics (GWA) supports McKinsey’s report saying that those who were working remotely before the pandemic will increase their frequency when they are allowed to return to the office. For those who were new to working remotely when the pandemic hit, there will be a significant upswing in their adoption. GWA’s best estimate is that we will see 25-30% of the workforce working remote on a multiple-days-a-week basis by the end of 2021.

“The pandemic has shown that working remote is possible. We were forced to learn it and many people really liked it. For some, the way they work is now more important than who they work for. This is new!”

Daniel Hansen, OMNIA Global Founder & CEO

So, what could the future of work look like?

There’s no doubt that lockdowns have opened our eyes to how our working lives can be post-pandemic – particularly knowing that post-pandemic, our children will be in day care, kindergarten and school giving us much better working conditions than during lockdowns, where working remotely mainly was a stress test. Time said it bluntly “The pandemic revealed how much we hate our jobs. Now we have a chance to reinvent work.”

With people considering moving due to the ability of working remotely, it could prompt a large change in the geography of work, as individuals and companies shift out of large cities into suburbs and small cities. However, this subject is highly debatable as some argue that the big cities always will attract talent with their energy and amenities.

We will most likely see smaller workspaces as companies shift to flexible workspaces with employees coming to the office 2-3 times a week meaning fewer desks are needed. A survey of 278 executives by McKinsey in August 2020 found that on average, they planned to reduce office space by 30%. Although there are disadvantages of remote working and having virtual meetings rather than meetings face-to-face, the office savings may outweigh the costs from the disadvantages.

Finally, we will most likely experience a decline in business travel, now that we have all become familiar with the extensive use of videoconferencing and virtual meetings making jumping on a plane less necessary. McKinsey estimates that an approximate 20% of business travel will not return.

“What I have missed the most during the pandemic has been the creative part of my job: Travelling and meeting new people and through that getting new ideas. It has been a more effective year because I have had more time to do all the paperwork, but definitely also a more boring year. It’s the journey that should be fun, and honestly, the journey is a bit boring at the moment!”

Daniel Hansen, OMNIA Global Founder & CEO

Then, what about the downsides of remote work?

So, while many of us see the advantages of this transformation, we have to be aware of the disadvantages. According to McKinsey, there is some work that is best done in person – although it is possible to do it virtually. Negotiations, critical business decisions, brainstorming sessions, providing sensitive feedback and onboarding new employees are examples of activities that may lose some effectiveness when done remotely.

If a company chooses to offer their employees to work remotely, while still having people coming to the office every day, there is also a risk of creating a divide between these two groups of employees. Will it be the employees at the office who are more likely to receive promotions? And what about the company culture and social interactions?

“When you run a company with a remote workforce it requires that we meet occasionally to create and maintain a team spirit. There is only so much you can do on Zoom! Because of the pandemic, we have employees who have never met each other. And we have missed celebrating all the good things happening together. We definitely need to give it some extra on the other side”.

Daniel Hansen, OMNIA Global Founder & CEO

Will we seize the moment?

The pandemic has forced us to ask ourselves if our working lives still make sense to us on the other side of the pandemic. How many hours do I want to spend in a giant office from 9-5 – and how many hours do I want to be away from my children? Do I want to live somewhere else if working remotely is an option? And even – do I want to change career? According to Time: “(…) people are not just abandoning jobs but switching professions. This is a radical re-assessment of our careers, a great reset in how we think about work.”

This is an opportunity to bring some more balance into our lives with more flexible jobs whether that is through moving to the countryside to work fully remote or through commuting to the office two days a week.

This moment in time seems like a very good opportunity to re-evaluate how we spend our time and live our lives.

“Our society has gotten a wild and necessary wake-up call. We have realised that we do not have to sit at the same desk every single day. Knowledge-based and creative jobs can be performed anywhere! I really hope for more flexibility – whatever works for the employee should also work for the company. If you do your job well, it should be up to each individual how and where you do it.”

Daniel Hansen, OMNIA Global Founder & CEO

Why combining fine art and private equity clashed – our learnings from the OMNIA Bond 1.0

What was the state of the art market when OMNIA entered?

Following the financial crisis, it was obvious that the banks was forced to only finance against liquid assets, primarily stocks and bonds, and the only illiquid asset they took in was real estate. Previously, banks were able to offer their clients liquidity based on luxury assets such as art, classic cars, diamonds and other investment objects, but that service disappeared overnight. After a while, different funds with different legislation and more freedom to decide their own investment strategy and credit risk appeared, and they took over the market for banks within lending against different luxury assets with art being the no. 1 asset to lend against.

What was the market in need of?

Many of the asset owners who borrowed against their assets did it to follow an investment object or project, or simply to get liquidity. But the people I paid most attention to was those who had this valuable piece of art, which they would like to keep, but they would like to borrow against it to invest in a project for a return – in order to turn the intrinsic value of the artwork into a cashflow. Looking at the amount of loans issued, which was around USD 20bn, it was just a tiny percentage of the total value of art, which some believe to be worth 2,500bn, that was being lent against. What we found interesting was to combine the loan and liquidity, and with an investment with cashflow or upside – all in one offering. All in all, the dream was to make it easy for art owners, as we knew the interest for a simple setup for illiquid assets was very high.

Can you explain the setup?

There were three elements to the setup. The first one being the structure around the due diligence of the asset – getting it assessed, insured, authenticated and stored safely. The second element was approaching the market – the securitisation of the investment product meaning placing the asset in an instrument, which the capital market understood. That meant taking an illiquid asset, now with valuation, authentication and insurance, placing it in a bond or note, so that a family office, bank or insurance company could buy the securities, which were secured by the asset. The third element was the deployment of the investment – that is placing the liquidity in private equity investments, which provides a high return of approx. 15%, attractively more than the 6-7% that the capital market was pricing the notes. Thereby, the return matched the risk, which the art owner was taking, with enough cashflow from the investments to make it attractive.

Why did you call the OMNIA Bond 1.0 the perfect product for the capital markets?

Looking at mortgage bonds in Europe and particularly in Scandinavia, house owners are able to mortgage up to 80% of the property value despite real estate being an illiquid product with no cashflow, and the general increase in value is nowhere near that of the art market. Nevertheless, banks consider real estate as one of the safest investment products out there. With a higher annual appreciation in value for art than real estate, and a loan amount limited to 50% of the appraised value, I consider art a safer investment product than real estate. On top of that, we offered the capital market a product where the capital was invested in private equity with an average 15% annual return. To me that makes the perfect product offering for the capital market.

Why was it not what the capital market demanded?

What we learned was that there is a big difference between what the art market should buy and what they were looking to buy. And apparently, the motivation to buy a product is not always in the client’s best interest, but holds a great job risk for those taking the decisions. For example, as no one else offered art bonds, it was impossible to get credit rating on the art bonds, and without official credit rating, each individual asset manager had to decide on the risk and their internal credit rating of the bonds. If things do not turn out as planned, you as the asset manager who set the credit rating have to defend your rating, and then it might be easier to avoid the offering to begin with.

It was possible to get credit rating on the insurance of the bond, but only if the offering was more than USD 500m, which meant that the first offering had to consist of quite a lot of art! Finally, it turned out that it was very difficult for the capital market to understand the combination of art and private equity in our structure, as those involved in private equity and art are very different groups of people. We took two very different asset classes and combined them. The art owners thought it was a great offering, and we thought it was a great offering for the capital market with a high interest, but it did not work, because they simply did not understand it – was it an art product or a private equity product?

What were the main obstacles with the bond?

When you create a private equity fund, you spend two years raising the capital, five years investing the capital and building the companies, and then several years selling the companies – meaning it is a rather time-consuming process. We looked at companies with a high return and growth, which are typically SMEs. But that also meant we had to buy 15-20 companies to match the value of the bonds. Looking back, the entire setup was extremely time-consuming and required a much bigger team than we had for it to be an ongoing business.

What did you learn from the process?

We learned from the bond that issuing bonds or notes and using them as a loan in an investment company that acquires companies and sell them later was way too complicated. What we could do instead was take what we had learned and create a structure with fewer art owners. Now, we match few investments, for example our SPACs, with each client’s or investor’s need and leverage. We see version 2.0 as a cooperation with very few art owners with a common investment strategy in a fund structure, with OMNIA Global Management as general partner, based on the value of the art instead of a bond structure.

Thereby, each art owner gets his or her own mini fund either issuing notes or a credit facility combined with another form of acquisition finance with a planned exit strategy. This means bigger deals with fewer art owners and fewer investments that match the leverage from the art piece, and therefore, we are no longer only looking at SMEs. This is a structure that works way better for us, as the issues we had with the bond has been removed. SPACs and reverse take-overs are well-know, so is using art as collateral for a loan as well as creating a fund in Luxembourg – that makes it way easier to get everyone on board when you are not creating an entirely new product, but just twisting familiar products a bit.

Why are we ahead with version 2.0 today?

We are ahead because we have taken all the beating and the risk over the last five years and learned from that. We did not just talk about it – we went into the market and learned everything about the art market in relation to the capital market. Since we have also been in the investment market for almost 15 years, and are entrepreneurs to the bone, we have a great understanding of how to create partnerships and joint ventures. We have tremendous experience in what to do and what not to do! And that is what happens when you are not afraid of being innovative. The consequence of that, though, was that we had to take the bonds off the market, and invited bond holders to be part of version 2.0.

SPAC is the new black

To those unfamiliar with a SPAC – a Special Purpose Acquisition Company, also known as a blank check company, it is a shell company with no commercial operations, which raises capital from public markets with the aim of later merging with a private company that wants to go public. When the merger is announced, shareholders can either accept stocks in the new company or redeem their shares at the original price of the offering.

In the US, 46% of the USD 103 billion raised in IPOs so far in 2020 went to SPACs.

The attractiveness of SPACs

SPACs are appealing to private companies as the listing process is much faster than with a traditional IPO – there is no need for a roadshow with a SPAC, which is typically needed for IPOs; and therefore, companies spend USD 750,000 and 18 months on average preparing for an IPO.

A special purpose acquisition company may serve as a suitable alternative to traditional IPOs when time, capital, or market conditions are more constrained.

gilmartinir.com

Avoiding roadshows and generally speeding up the process is generally appealing for hyped businesses, but is probably particularly appealing during the current pandemic and might be part of the explanation of the noticeable increase in SPACs.

When major players choose SPACs

In the 80s, reverse mergers, of which SPACs are a type of, were very popular. However, in 2011, the SEC (the American Securities and Exchange Commission) issued a fraud warning, urging caution when investing in companies that went public through reverse mergers.

This reputation has obviously had an effect on SPACs as well, but recently we have seen major players explore the opportunities of SPACs, which is very likely to have removed some of the stigma related to SPACs.

Branson is making his first foray into an increasingly popular form of investment vehicle, and one he himself tapped in order to list Virgin Galactic.

Bloomberg.com

Some of the examples are Richard Branson’s VG Acquisition Corp., as the SPAC will be known, which plans to raise USD 400 million by selling 40 million units at USD 10 apiece, DraftKings, whose valuation has surged from about USD 3 billion to more than USD 13 billion after going public through a SPAC in April 2020, as well as Bill Ackman’s Pershing Square Tontine Holdings, which raised USD 4 billion to become the largest SPAC in history.

Time will tell if the entering of major corporations on the SPAC scene will make SPACs mainstream beyond the pandemic.

A golden opportunity for the private jet industry

As Covid started spreading across the globe in early Spring, both the commercial airlines and the private jet industry took a very hard hit. But then something happened with the private jet industry; clients came back in great numbers and noticeably, many first-time clients made bookings.

In May, commercial passenger demand was down 91.3 per cent compared with a year ago. By contrast, private flights dropped 70 per cent year on year in April but were down only 28 per cent in June, (…).

ft.com

PERSONAL TRAVEL BRINGING BACK THE PRIVATE JET INDUSTRY

While busines meeting after business meeting and conference after conference got cancelled, a majority of the private jet bookings were now for leisure travel due to the lack of commercial flights. Furthermore, people with the financial possibility chose private jets to avoid the health risks associated with the crowded commercial flights, as well as the many touch points going through the major airports, which are avoided with private jets as they depart from small, private terminals.

INVESTING IN FLEET AND TALENT

The current economic downturn has created a window of opportunity for the private jet industry. Private jet companies are currently taking advantage of this unprecedented downturn in the aviation industry and the economy in general to acquire new aircrafts at more favourable terms and prices.

“The day after the Fourth of July, when commercial airline travel was down 74 percent year-over-year, private jet flights were up five percent, (…).”

nytimes.com

But private jet companies have not only added aircrafts to their fleet – they have also added more pilots. For long, private aviation has experienced a shortage of pilots, but with major airlines furloughing thousands of pilots due to the pandemic, it has now become possible to attract talent. Thereby, the corona crisis has turned into a golden opportunity for private jet companies in terms of an extended talent pool and available aircrafts.

A TIME TO INVEST IN ELECTRIC ENGINES?

At this point in time, where everything is up in the air, another golden opportunity for the private jet industry is to start investing in electric jet engines to take steps towards carbon-neutral air travel. With electric engines, private jet companies would be able to issue green bonds, which can help finance this transition.

CHANGED HABITS

The question is now whether the aviation industry has changed for good? Both the commercial airlines and the private jet companies have experienced a tremendous fall in business trips due to worldwide travel restrictions, and as we all get more and more used to online business meetings it is easy to imagine that the amount of business trips never will go back to normal.

One company, one brand

Today, we launch an updated version of omniaglobal.com, while at the same time letting go of our subsidiary brands and websites. Instead, we have added the subsidiaries’ business areas to the OMNIA Global umbrella. You will find them all here.

Creative thinking in a conservative market combined with innovative entrepreneurship.

OMNIA is still the same though; an entrepreneurial family office specialising in alternatives, private to public investments with use of innovative finance and leverage within structured finance in order to consistently grow our balance sheet.

The changes are simply strategic in order to simplify our brand and how we communicate with our clients and network.

We still aim for the same goal: To do better – for our clients, our network and employees.

Green bonds

Green bonds have been around since 2007, when the European Investment Bank issued its Climate Awareness Bond, and the World Bank issued its green bond after a phone call from Swedish pension funds looking for climate investments in 2008. Since then, we have seen a noticeable increase in the issuing of green bonds – particularly over the last couple of years and particularly in Europe. In 2019, the wider European market accounted for 45% of global green bond issuance.

Global green bond and green loan issuance reached USD 257.7bn in 2019, marking a new global record.

Green bonds are part of the strengthening of the global green transition, which especially aims to reduce carbon emissions, as well as being an answer to the increasing investor interest for sustainable options with a measurable effect. This investor interest in a social and environmental purpose of their investments reflects a fundamental shift in the bond market.

Using debt capital markets to fund sustainable solutions

A green bond, or climate bond, is a fixed-income instrument designed specifically to fund green, i.e. climate or environmental, projects or investments, such as renewable energy, energy optimisation and other green projects, which contribute to reducing CO2 emissions. The bonds can be issued by both public and private companies.

The majority of green bonds issued has green use of proceeds or are asset-linked bonds. Proceeds from these bonds are set aside for green projects, but they are backed by the issuer’s entire balance sheet. Also, the same credit rating applies to the green bonds as for the issuer’s other bonds.

As requirements for green bonds are different than regular bonds in terms of tracking, monitoring and reporting on use of proceeds, green bonds have some additional transaction costs. However, the Climate Bonds Initiative, a non-profit international organisation, states the following advantages of green bonds: They highlight the issuer’s green assets/business, create a positive marketing story and diversify issuer’s investor base (as the issuer can now attract ESG/RI specialist investors).

The lack of regulations for green bonds

When is a “green bond” truly green? Despite the definition of a green bond above, there is not an official set definition of a green bond or a sustainable investment. As of now, the green bond market is unregulated, however, certification schemes and guidelines, such as the Climate Bonds Standards, the Green Bonds Principles from International Market Capital Association and Bloomberg Barclays MSCI Green Bond Indices are available to issuers and investors, but on a voluntary basis and without explicit definitions.

Since March 2018, the European Commission has been committed to create standards and labels for green financial products. As part of the EU’s 2020 strategy for sustainable finance, the EU will launch a Green Bond Standard, which will set up minimum safeguards that activities have to comply with in order to qualify as environmentally sustainable, however, the Standard will most likely be voluntary and non-legislative.

Bonds that are issued in the green segment of big stock exchanges, such as the London Stock Exchange, need to have a green label, which must be certified by an agency. But again, there is a lack of legislation in terms of third-party rating agencies and green bonds together with the variable definitions of green bonds.

And one thing is the green bond itself – another factor is the issuer; how green is the company issuing the green bond? Currently, it is very difficult to assess and compare the sustainability level of a company. One way of doing it is through a company’s ESG rating (Environmental, Social and Governance) – but as with the bonds, there is an issue with varying approaches to the ESG ratings by the rating agencies. ESG ratings simply lack regulated methodologies.

With no legislation the green capital market is to a large degree based on self-regulation, market demand and investor research. Today, nothing prevents companies from pollution-intensive industries to issue seemingly “green” bonds.

Greenwashing green bonds

With the lack of regulation on the market of green bonds, there is a risk of greenwashing. The increased global focus on the environment and sustainability leads to a tremendous marketing potential in presenting your company as green.

Greenwashing is the process of conveying a false impression or providing misleading information about how a company’s products are more environmentally sound.

Investopedia.com

The temptation of a new green logo might be bigger than the reality of how green one company operates. The same goes for the green bonds due to the increased investor demand for green investments. The contradictory term “clean coal” is one that clearly shows how companies and industries urge to appear green – but it also makes the need for regulation on the market for green bonds stand out.

Purpose matters more than ever

With the noticeable change in investor interest, where the purpose of the investment has become significant, there seems to be endless possibilities for bonds of all the colours of the rainbow. A great place to go from could be the UN’s 17 Sustainable Development Goals, which each focuses on a global goal, such as poverty, inequality, climate change, environmental degradation, peace and justice – each goal with its own colour symbol.

We have already seen social bonds that raise funds for projects with positive social outcomes, as well as blue bonds that finance marine and ocean-based projects with positive environmental, economic and climate benefits.

What colour will be next?